Stop Overpaying Your Vendors

90% of businesses overpay vendors without realizing it.

We deliver savings by combining Category Expertise + Proprietary Pricing Intelligence

For Telecom, Utilities, Waste, Merchant Processing, and more.

Our Process is Simple

≈ 3 hours of your team’s time

No savings = no fee

Keep your current vendors

From Fortune 500s to Local Businesses: We Deliver Results

Thousands of businesses served across industries like healthcare, retail, and manufacturing and many more

20-40% average savings found without disrupting operations*

*Average savings vary across categories and have been as high as 95%

Our Approach

Most companies know they’re overpaying somewhere but figuring out where, how much, and why is the challenge. Vendor contracts are dense, fees are buried, and bills are designed to confuse. Finance teams don’t have the time to investigate every line item, which means millions can quietly leak out every year.

That’s where we come in. P3 has spent decades breaking down cost structures across industries. We bring vendor-specific expertise, decades of category expertise, a proprietary database of benchmarks, and proven processes that uncover hidden savings quickly and accurately.

30 Days to Value, 90 Days to Savings

Onboarding + invoice collection

Day 0

Engagement kicks off

Initial analysis from P3 experts

Day 30

Actionable savings identified

Findings reviewed and approved

Day 30-45

Green light for implementation

P3 executes vendor negotiations & corrections

Day 45-90

Changes applied with vendors

Verified cost reductions hit bottom line

Day 90

Measurable ROI, cash flow impact

Our Value Proposition

1

Risk-Free Savings Review

You share recent invoices, vendor contracts and execute our shared savings agreement. That’s it. No lengthy prep, no new projects for your staff.

2

Forensic Expense Audit

3

Proprietary Benchmarking

We use our database of proprietary vendor benchmarks to further uncover savings opportunities. We know exactly what pricing the vendors are willing to accept across all your locations. We handle the tough conversations with your vendors, lock in savings and let you stay focused on your business.

4

Shared Savings, Zero Risk

Common Problems We Solve

- Hidden Fees & Creeping Costs

Vendors quietly increase rates, fees, and surcharges—eating away at margins quarter after quarter. Understanding which fees are valid, and which are profit centers, is a full time job.

- Opaque Vendor Contracts

Complex, one-sided agreements lock you into bad deals for years with no leverage to renegotiate. You might think everything is ok, but there is a reason we find savings at 90% of clients.

- Billing Errors and Overcharges

Your vendors make mistakes. When was the last time you received a call saying they made a mistake and were refunding it? The burden of finding them is on you, and they take expertise to uncover.

- No Time or Bandwidth

Finance teams are already stretched thin. Between getting us the data and approving results our engagement takes about 3 hours of total client time.

- Ease of Operations

Changing vendors is not required to achieve savings. We take into account our client’s operations. We know speed and ease of implementation is critical.

- Lack of Benchmark Data

Without insider pricing benchmarks, businesses never truly know if they’re getting the best deal or quietly overspending year after year. RFP and quotes do not lead to the best price.

Related Services

Utility Auditing (Electric, Water & Gas)

Telecom Auditing(Phones & Internet)

Waste & Recycling Auditing

Merchant Processing Auditing

Uniform & Linen Auditing

Managed Print Auditing

Small Parcel Shipping

Want to see how much your business could be saving?

Our Results:

Savings That Speak for Themselves

We’ve helped thousands of businesses uncover millions in hidden savings. On average, our clients see 20–40% expense reductions in less than 90 days—without changing operational processes.

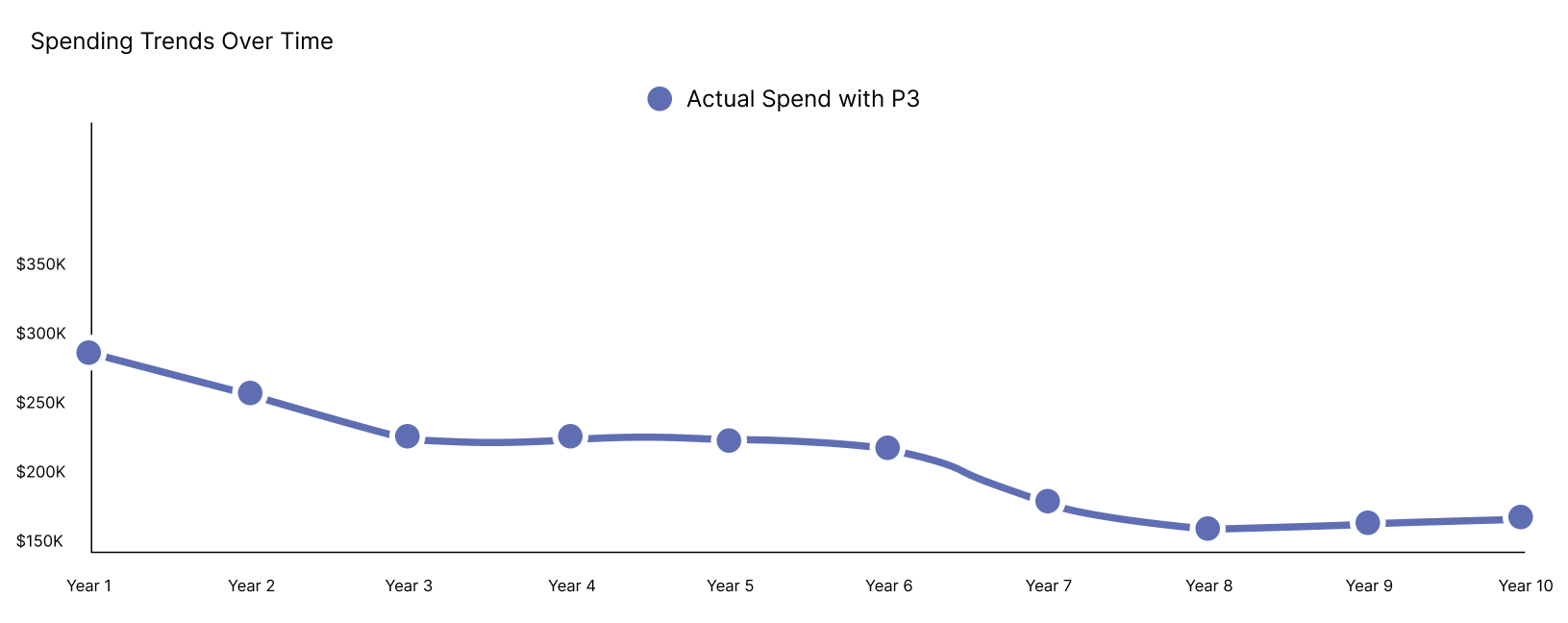

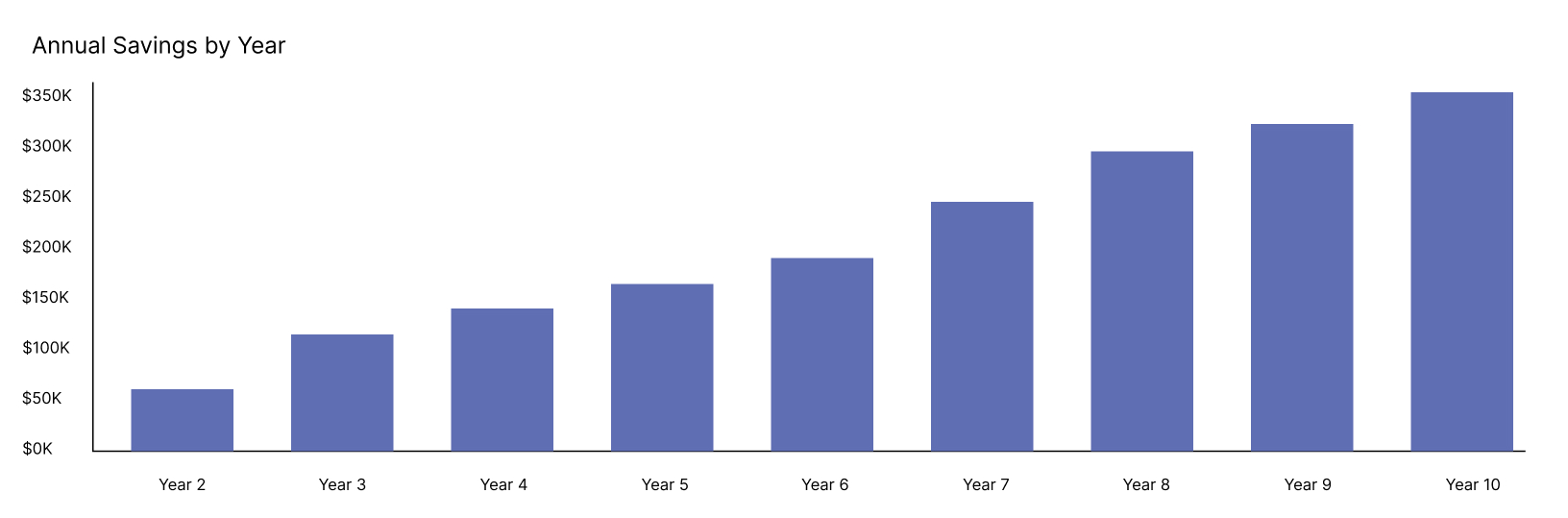

Client Overview: Multi-Location Fast Food Operator

In this engagement we helped the client reduce their waste and recycling expenses across 70+ locations. We significantly reduced expenses early in Year 1, drove them even lower over time, and monitored and managed them going forward. This client is still a client to this day and we’ve worked with them on numerous follow-on engagements with other cost reduction categories.

Why Businesses Trust P3

We don’t just skim invoices for “easy wins.” Our analysts dig deeper, uncovering savings that competitors often miss, all while keeping the process simple for you.

Forensic-Level Detail

Every line item and contract clause is analyzed against benchmark data to expose hidden costs.

U.S.-Based Expense Experts

With 30+ years of experience, our analysts know vendors’ tricks and how to stop them.

Proven, Zero-Risk Model

You only pay if we save you money.

No savings, no fee.

Our Clients Success

“They kept their promise and ensured our expenses were accurate at no cost. We’d recommend them to any business.”

Co-Owner

Trusted by growing business

“After all is said and done we will be saving over $8,000 per year after their fees, across our 18 locations.”

President, BRM Foods

“They verified that our expenses were accurate, at no cost. You cannot lose by giving P3 a shot. I would recommend their service.”

President/COO

“We just met with the folks from P3 cost analysis and very happy with their findings.”

President & CEO

“P3 Cost Analysis came to the plate and got the job done, happy about all the auditing that they got and all the savings.”

Property Manager

“We used P3 Cost Analysis to review our utilities and had a great result with the things that they found and were able to correct for us.”

“Cost savings that we had with our audit from P3 Cost Analysis it has saved the credit union money and has given us a better understanding of our billing.”

About P3 Cost Analysts

(It’s Not About Us. It’s About Your Bottom Line.)

Most companies unknowingly waste 20–40% of their spend. We exist to stop that. With 30+ years of exposing hidden costs, P3 Cost Analysts has helped thousands of businesses keep millions in profits that vendors tried to quietly take.

Mission

We empower executive teams to boost cash flow EBITDA by deploying our proprietary vendor benchmarks and category expertise to expose and eliminate needless vendor costs in 90 days, turning cost control into a strategic advantage that outpaces competitors.

Vision

Empower 10,000 enterprises to reclaim $1 billion in overhead spend and double their capacity to grow and retain employees.

What Makes Us Different

P3 Cost Analysts combines detailed invoice audits, proprietary vendor benchmarks, and strategic vendor engagement to uncover hidden costs fast, delivering measurable savings in as little as 90 days. Our risk-free approach helps clients reduce overhead without operational disruption.

Real Experts. Real Results.

For 30+ years, our U.S.-based team has gone toe-to-toe with vendors to uncover hidden savings for our clients. We don’t offer advice, we deliver results. Our team digs deeper, negotiates harder, and ensures you only pay what’s fair.

With franchise offices across the U.S., our U.S.-based team of industry-leading auditors digs into expenses like utilities, telecom, waste and recycling, merchant processing, uniform and linen, managed print, shipping, insurance and property tax. We don’t just review invoices, we forensically analyze them, benchmark costs across industries, and negotiate directly with vendors on your behalf. That is why over 90% of the thousands of companies we have served, from small businesses to Fortune 500s, have realized real refunds and sustainable savings, many in the hundreds of thousands of dollars. And because our model is 100% risk free, you only pay if we deliver results.

Frequently Asked Questions

1. Why do I need a cost reduction audit?

We will start by saying there is a 10% chance you do not. We find savings at 90% of the clients we work with. So, there is a 90% chance that we will either find you meaningful savings, or you will receive a free review by experts.

If you are in the 10% where we do not find savings, we simply say thank you for the opportunity and you can rest well knowing that experts, who solely make their living doing this, could not find anything.

Conversely, we will deliver found money to your bottom line. We believe both of those are great outcomes for our clients.

Especially considering the return on investment is infinite (no upfront costs) and the ROI on time is incredible as well (approximately 3 hours of total client time needed per engagement).

2. How much does a cost reduction audit cost?

We only bill a client if we save them money. If we are unsuccessful in saving money, there is no fee. If we do find savings, we simply share them 50/50 for a finite period of time (from 12-60 months, depending on the level of service our clients desire).

So, our clients receive 50% of our work product right from the start, with no upfront investment. And then, after a finite period of time, they benefit from 100% of our work for the lifetime of their business. We think that’s a pretty good deal.

The worst-case scenario is that we do not find any savings and you’ve had an expert review by analysts whose sole responsibility is to identify savings. While we certainly prefer to find savings and make money with our clients, we don’t feel that is a terrible outcome either.

3. Are there any upfront costs associated with a cost reduction audit?

There are no upfront costs whatsoever. You will only pay us if we find savings for you, if you agree to them, and if they positively impact your bottom line.

We understand that this may lead some potential clients to believe that our service is “too good to be true.” But the fact of the matter is, we find savings 90% of the time. When bring forward good savings opportunities and improve our clients’ bottom line, we make money with them. Our motives are 100% aligned with our clients.

4. How do you determine potential cost-saving opportunities during the audit?

Potential cost-saving opportunities are identified by comparing your historical costs with what we achieve for you.

While the data, expertise, and P3 man-hours needed to bring these savings forward is immense, the math needed to understand the savings is not.

Pricing improvements, fee reductions, tax removals, error corrections, refunds, etc., are all straightforward to calculate and are black and white. We invite you to explore our services pages, whitepapers, and case studies to see the myriad of examples of errors and overcharges that can occur, which we fix for our clients.

For the skeptics, there are a couple of important things to keep in mind:

1. Our clients must ultimately approve our recommendations. Our recommendations are approved well over 95% of the time. We are not going to invest all our time and energy in conducting an audit only to come back with recommendations that do not make sense for our clients. That would be a waste of everyone’s time, and certainly our time, since we do not bill any upfront costs. Our recommendations require almost zero work from our clients, are financial in nature, and are almost always approved as a result.

2. We spend countless hours auditing your invoices to identify cost-saving opportunities. We certainly would not do that and then turn around and expect our clients to pay our invoice if they do not understand it. Our invoices include a detailed analysis that clearly indicates where the savings are, down to the line item level. Furthermore, you can see on the invoices themselves where the cost savings are evident.

5. Will you switch my vendors?

Generally speaking, we prefer to keep our clients with the same vendors for the sake of operational simplicity. Making a change can be a headache. But it’s something we are certainly willing to do, and we do it as needed, to ensure that our clients receive the highest level of service at the most competitive price.

So, the short answer is ‘no’. The longer answer is “we can, if you would like us to.” The longest answer is that there is a lot of nuance in cost reduction consulting. In some categories, it’s easier to terminate vendor agreements than in others.

Furthermore, geographic location can play a huge part in the market. Almost all of the cost reduction categories we work in have local market nuances due to regulations, varying levels of competition, and a variety of other factors.

To put a very rough number on it approximately 90% of the time it will make the most financial and operational sense to stay with your current vendors. But we won’t know for sure until we understand your unique needs and situation. And ultimately the decision is yours.

6. What makes you all the experts on this?

Nothing but a lot of focused time, energy, and data. Our analysts have worked for your vendors in many cases (and in some cases even managed them).

We know all the ins and outs of the industry and have tens of thousands of data points to compare. So, we know exactly what the vendors do, the errors that can occur, and how to achieve the best possible outcomes for our clients.

It is no different from the expertise you have. You are experts in your business. We wouldn’t pretend to know how to run a manufacturing facility, school, hospital, restaurant, or any other type of business you are in.

But when it comes to understanding your vendors and every intricate details of these expense categories, we are certainly experts at that.

7. Yes, but I already have a team of people who handle this.

If you or your team does all four of the following, we would agree that it may not be worth the minimal time investment to allow us to review. But even then, we always ask, “Why not?”‘.

We are confident enough in our abilities that we would be happy to invest dozens to hundreds of hours to double-check.

- Is the person managing the XYZ expense category solely responsible for managing that expense, or do they have other duties as well?

- Are they incentivized to save every dollar based on a performance basis in that specific expense category?

- Do they have over 10 years (minimum) of sole focus on this particular expense category, doing nothing else each day?

- Do they have access to thousands of other comparable data points across industries, organizations, and peers outlining comparable costs (at a line-item level) of this specific expense category?

8. My team doesn't have time for another project. How long does this take?

We hear this one often. In fact, it’s one of our top 5 biggest misconceptions. The fact of the matter is that this will take about 3 total man-hours of your team’s time. We estimate the following:

- Step 1. 15-30 minutes – Pre-sales call with executives (typically CEO, CFO, President, or Owner)

- Step 2 (provided the client engages with P3) 60-120 minutes – The client provides P3 with either copies of necessary invoices/contracts or access to online logins. P3 then pulls the data for the client.

- Step 3. 15-30 minutes – Findings review calls. P3 reviews findings line by line with the client. Upon client approval of the findings, P3 proceeds with the implementation. Implementation is done 100% by P3’s team of analysts.

9. How do you ensure that cost reduction measures do not compromise the quality of products or services?

Your vendors will still be making a profit. They have to be; otherwise, they would turn off your phone lines, utilities, or any other service they are providing.

Our goal is just to ensure that you receive the service you need at the best possible cost. The only way to effectively do this is to have these expenses audited.

Unfortunately (or fortunately for our business), the fact of the matter is vendors make mistakes. They make mistakes, and they are going to try to maximize profit at every opportunity.

It’s our job to use our expertise and data to keep that “in check”.

But the vendors will continue to service your account happily (and if there are any operational concerns you’d been experiencing, we can certainly help address those as well). Our goal is to ensure that our clients are not the vendor’s highest margin customers and that they are billed accurately or are refunded for any errors.

The vendors have plenty of customers out there happily overpaying, just not the ones that work with us.

10. How do you handle sensitive financial information during the audit process?

We utilize the Microsoft ecosystem for our data storage and sharing. This was created by one of the biggest organizations in the world and trusted by millions of others.

Furthermore, the documents shared are typically not highly sensitive in nature. We do not handle bank account information or sensitive patient data (assuming a healthcare client). We are simply reviewing invoices and contracts for overhead expenses.

That being said, we treat all our client data with the utmost care.

Ready to Uncover Hidden Savings?

Our team of experts has saved clients millions by identifying cost reduction opportunities across multiple expense categories. The best part is that if we don’t save you money, you don’t pay.